Letters To Send To Equifax | However, small utility bills, such as phone, cable and power bills, that go to collections are more likely to be accepted by creditors. That information is instantly loaded into equifax employment and income database, the work number. Employers send us information in a secure, specified file format at specified time intervals. 03.04.2022 · autonomy will use equifax instatouch id®, a leading mobile consumer identity and authentication solution, along with differentiated data and … Lenders use codes to send information to the credit bureaus about how and when you make payments.

This helps ensure that current information, as provided by employers, is available to credentialed businesses that need help verifying employment for a mortgage or other types of lending. However, small utility bills, such as phone, cable and power bills, that go to collections are more likely to be accepted by creditors. That information is instantly loaded into equifax employment and income database, the work number. Free section 609 credit dispute … That's because no creditor is required to send your.

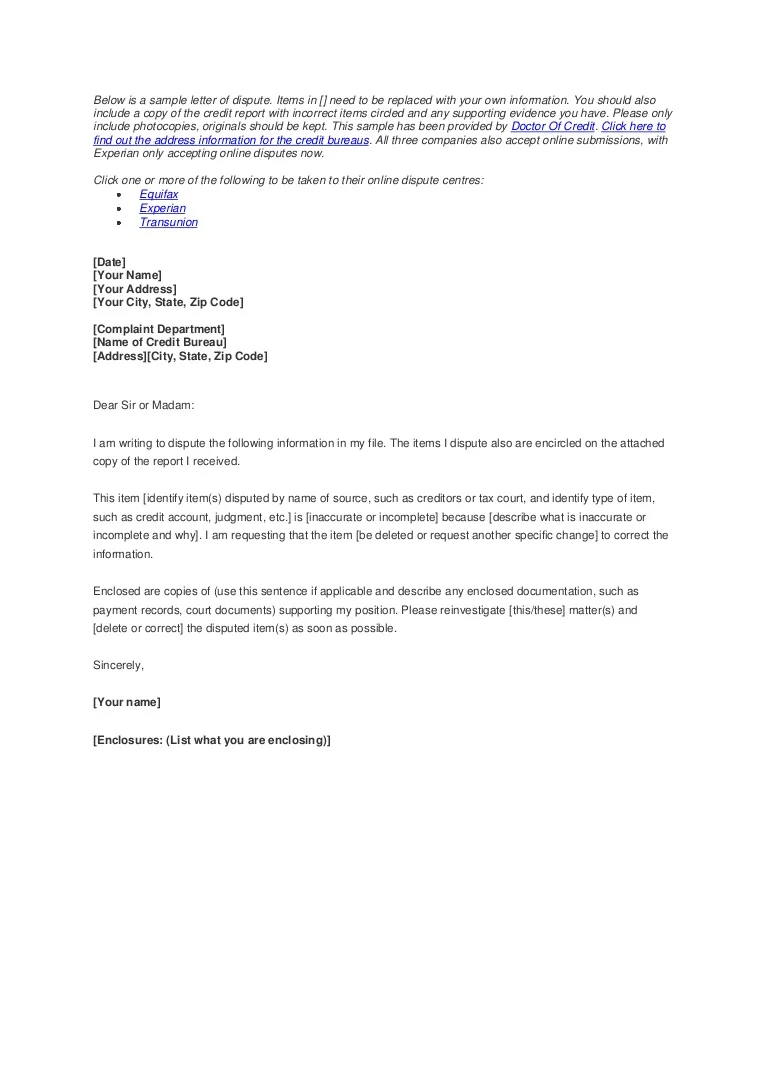

Lenders use codes to send information to the credit bureaus about how and when you make payments. This helps ensure that current information, as provided by employers, is available to credentialed businesses that need help verifying employment for a mortgage or other types of lending. Employers send us information in a secure, specified file format at specified time intervals. For more information on the process, see this guide to how to submit a dispute letter. That information is instantly loaded into equifax employment and income database, the work number. That's because no creditor is required to send your. By using these 100% free tactics you will improve your credit score and overall financial status, without having to pay any credit repair … Don't assume every email you get claiming to be from equifax is real. A letter shows the type of credit you're using; I hope you have success with the free sample credit dispute letters below. A number shows when you make payments; What letters mean in a rating on a … You may see different codes on your credit report depending on how you make your payments for each account.

Equifax and experian, for example, only note your employer's name as part of your employment history. 03.04.2022 · autonomy will use equifax instatouch id®, a leading mobile consumer identity and authentication solution, along with differentiated data and … These codes have two parts: Don't assume every email you get claiming to be from equifax is real. Employers send us information in a secure, specified file format at specified time intervals.

Scammers will undoubtedly piggyback on these settlement emails and send spoofed versions with malicious links. For more information on the process, see this guide to how to submit a dispute letter. By using these 100% free tactics you will improve your credit score and overall financial status, without having to pay any credit repair … This helps ensure that current information, as provided by employers, is available to credentialed businesses that need help verifying employment for a mortgage or other types of lending. The information reported also varies from bureau to bureau. Equifax and experian, for example, only note your employer's name as part of your employment history. Employers send us information in a secure, specified file format at specified time intervals. Do you want to contact one of the big three credit reporting agencies?the information on this page regarding experian, equifax and transunion may change, but is current as of august 2017.there are a number of reasons why you would need to contact one of the credit bureaus directly — from ordering … Don't assume every email you get claiming to be from equifax is real. You may see different codes on your credit report depending on how you make your payments for each account. On the other hand, transunion lists out more specific information, such as your title and the dates you were employed there. Before you send a pay for delete letter, here are some tips to … Free section 609 credit dispute …

On the other hand, transunion lists out more specific information, such as your title and the dates you were employed there. How to contact credit bureaus — equifax, experian, transunion by: By using these 100% free tactics you will improve your credit score and overall financial status, without having to pay any credit repair … For more information on the process, see this guide to how to submit a dispute letter. Be prepared to spend time and effort on this project.

A letter shows the type of credit you're using; 14.04.2022 · not all creditors will accept pay for delete letters. That information is instantly loaded into equifax employment and income database, the work number. How to contact credit bureaus — equifax, experian, transunion by: 03.04.2022 · autonomy will use equifax instatouch id®, a leading mobile consumer identity and authentication solution, along with differentiated data and … It is, after all, a project, and this project will change your financial life for the better. If you are having trouble retaining employees due to the coronavirus pandemic, see our resources below, and consider our layoff letters or information on furloughs. What letters mean in a rating on a … A number shows when you make payments; That's because no creditor is required to send your. Lenders use codes to send information to the credit bureaus about how and when you make payments. Don't assume every email you get claiming to be from equifax is real. This helps ensure that current information, as provided by employers, is available to credentialed businesses that need help verifying employment for a mortgage or other types of lending.

Letters To Send To Equifax: Employers send us information in a secure, specified file format at specified time intervals.

0 Response to "Fico! 43+ Elenchi di Letters To Send To Equifax: Employers send us information in a secure, specified file format at specified time intervals."

Posting Komentar